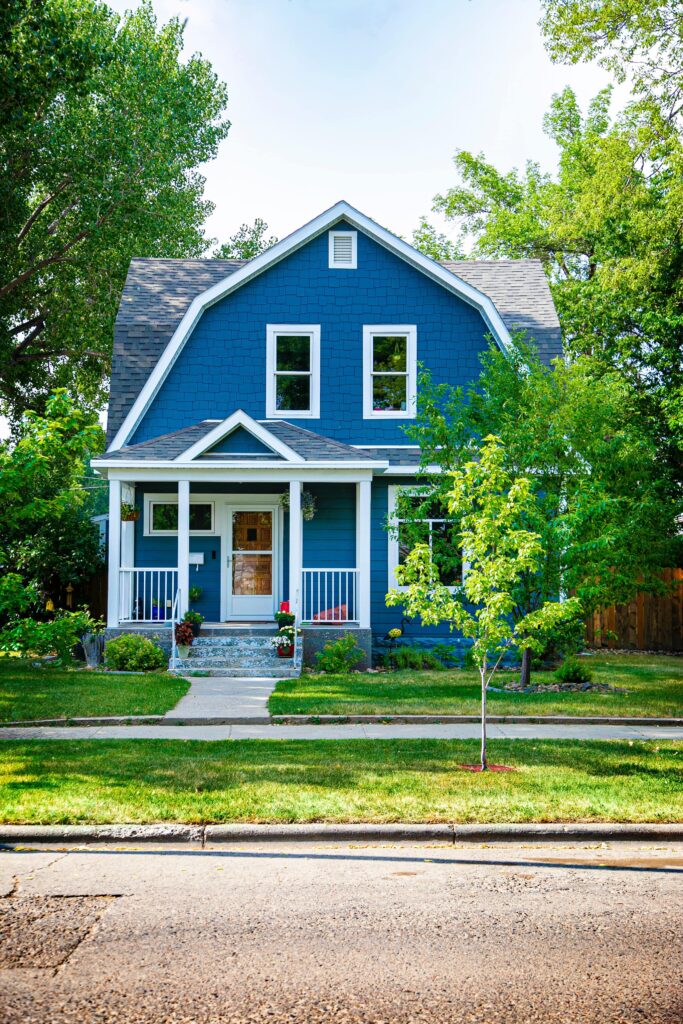

Real estate development in Jamaica can be quite lucrative.

There are projects that can bring in US$300,000 in profits over two years when done right.

But, it’s not enough to just want the big bucks.

You have to be willing to deal with the risks involved, put in the work, and avoid these ten rookie mistakes.

1. Taking On Too Much Debt

It’s never a good idea to borrow more than 80% of the purchase price to buy an investment property. There are many ‘get-rich-quick’ schemes and self-proclaimed online gurus promoting ‘no cash down deals’.

These schemes and deals present many risks, even for experienced real estate investors. There are too many opportunities for things to not go according to plan.

Too many things must go right for these schemes and deals to work. Things such as:

- The rehab work staying within budget and finishing on time

- Finding the right tenant just in time and the tenant paying you exactly what you asked on time

- The property being fully booked for the next two to three years

- Operating expenses being less than budgeted

- The property selling for more and in the shortest possible time

- Finding the best property manager

The chances of all these things happening is slim.

Let’s say your uncle comes to you with what looks like a highly profitable real estate deal. You want to jump on this deal quickly so that you don’t miss your chance to earn huge returns. At least that’s what this deal looks like; a quick way to earn a lot of money.

But, you soon realize the costs aren’t worth the gain. For example, you may be forced to sell the property because you can’t cover the operating costs or sell it for less than what you wanted because of the high costs to keep the property on the market for sale (holding costs).

You may also like this article – How to Get Started As a Real Estate Developer in Jamaica.

2. Underestimating Rehab Costs

You’ve bought your first investment property. It seemed like a property that just needed a little sprucing up; a bit of paint on the walls, some new kitchen cupboards, nothing too expensive or time consuming. You’ve watched enough HGTV shows to know that this fixer upper should be an easy fix.

Your plan is to fix it up quickly so that you can sell it for top dollar. Even your real estate agent agreed that this would be a quick flip.

But, you have no construction experience and spent all your savings on the closing costs to buy the property. You’re excited about getting new fixtures and even kitchen cupboards. You even pitched in to help the painter give the interior a nice face lift.

There’s even a little money left over to add additional electrical plugs to update the property. You feel like a winner! Turns out though that the pipes leak, the toilets are clogged, and the electrical wiring is not up to code.

So, what do you do? You charge the additional cost to your credit card or sell the property at a discounted price because you’re unable to complete the repairs.

In a seller’s market, you won’t get a quote from a contractor before you buy a property. So, it’s best for you as a first time investor to avoid older properties or properties that need a lot of work.

Definitely avoid properties where you may want to change the floor plan as this will mean installing new floors, plumbing, and electrical. You may even need a structural engineer.

Let’s say you found the right investment property that only needs some basic cosmetic repairs. You should still budget for a few major repairs such as repairing the roof, changing leaking pipes, and upgrading electrical wires. A contingency of 10% to 20% of the budget, depending on the project, should be enough.

3. Inadequate Savings For a Downpayment

You can make competitive offers on investment properties if you’re able to put down at least 25% for the downpayment and set a target price that you’re comfortable with. Don’t start out trying to get rich on that first property.

Remember that you’re still learning. So, it’s best to start out with a manageable property that’s well within your budget.

You’ll be competing with other investors who’re able to make cash offers in most instances. In these situations, your market research will help you select neighbourhoods and suitable property types that may not be in such high demand by other investors.

You may also like these articles:

How To Invest In Residential Real Estate In Jamaica

How To Invest In Commercial Real Estate In Jamaica

4. Falling In Love With The Property

It’s easy to fall in love with a property that’s outside your reach. But, that only leads to disappointment.

Remember to keep your emotions in check and stick to finding the right investment properties for your needs. Some questions you can ask include:

- Is the property located in one of your preferred neighbourhoods and on a good street?

- Can you buy it for at least 20% below the market price?

- Can you get a return of at least 6% per annum on your cash investment if the property is for rental income?

Generally, the best properties are the ones that have the highest potential for adding improvements that will add significant value to the property. If the property is already set up to suit your tastes (meaning you can imagine yourself moving in), it’s less likely you can make money on it.

In other words, you’re probably paying market price instead of buying it at a discount. It will take longer to recoup your investment.

5. Over Improving Investment Properties

Not all property improvements will lead to more money. Be careful not to do more than what’s expected by the market for properties in your price point.

Talk with your real estate agent about the basic features that will sell the property or attract good tenants. Attend open houses to get a feel for the range of the quality of the features offered by other investors or developers.

You don’t have to put in more than what they do, but your property should be comparable. Run the numbers to optimise how much you will actually need to spend.

The goal is to select materials within your budget that will be comparable but still allow you to make a profit. Remember, a property that is too expensive may stay longer on the market and a property that doesn’t have the basic or standard quality features like similar properties may also sit on the market while their better-looking counterparts sell first.

6. Looking for Your Dream Property

Many people who want to invest in real estate use being unable to find their dream property as an excuse to avoid investing. You won’t find your dream property if you set near-impossible selection criteria. This is the equivalent of looking for a unicorn or gold at the bottom of the river.

The same applies when it comes to real estate investing. All your criteria for making money will not be perfectly met. Don’t wait to make offers because the deal is not perfect. But, don’t make offers on obviously bad deals.

Your initial goal as a new investor should be to actually do your first deal. I encourage you to start making offers after you’ve set the framework for identifying your preferred investment property and have saved up enough money.

Don’t spend too much time studying about real estate investing because eventually you’ll need to put that knowledge into practice. Your first deal may not be a record win. But, you should recover if you follow the basic financial and investing principles. You’ll still learn some valuable lessons along the way.

7. Buying Cheap Houses In Bad Neighbourhoods

I mentioned earlier that you should start with manageable and affordable properties. But, this doesn’t mean cheap properties in any neighbourhood will make good investment properties.

Investing in less than desirable areas is a bad idea because you may not be able to collect rent, evict tenants, or even recover your initial investment after being forced to sell. Other factors to consider are:

- The quality of the general infrastructure

- Whether the neighbourhood is undergoing adverse change

- Crime statistics

- Whether there’s any major infrastructure nearby that will make the area undesirable such as a busy toll road or noisy airport.

- If the area is prone to flooding or landslides

- The maintenance of the roads and storm drains

- Whether businesses and other essential services are closing down or moving to other towns

- Whether the area is changing from residential to commercial or the other way round.

These criteria are important considerations when you’re considering real estate investment in Jamaica.

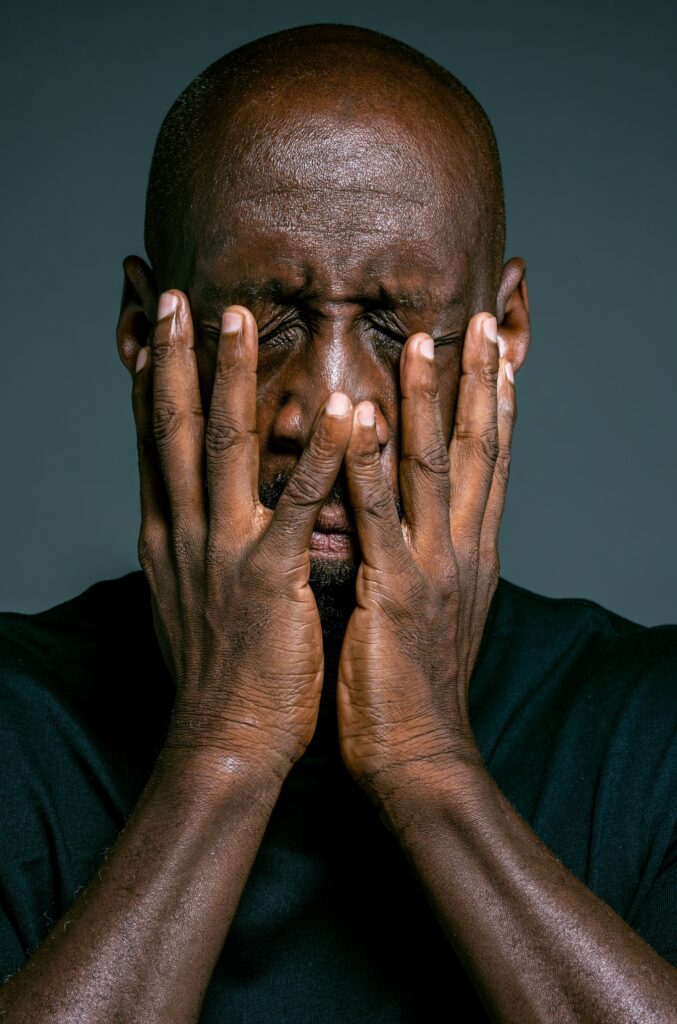

8. Doubling Down On Bad Investments To Recover Losses

Know when to quit. There’s no point staying in a bad investment or even investing more money in a deal to recover losses.

Remember that your investment strategy is based on recovering your initial investment within a given time. This should be less than two years for deals where you’re selling to make a profit even if it involves extensive repairs and building permits. You should recoup your initial investment in five to seven years if you’re holding a property for the long term.

9. Being Too Quick To Partner With Family And Friends

So, your cousin who you used to spend every summer with at your grandparents’ house in the country when you were children now wants to partner with you on a deal. Think twice.

Usually, the most successful partnerships on real estate deals are those where the persons involved:

- Share common goals and values

- Are clear on their respective roles and responsibilities

- Prefer to resolve conflicts using constructive techniques

Your partner should have skills that complement yours and everyone’s opinions should be respected and valued. Everyone should agree upfront on how decisions are to be made.

If you’re good at finding and negotiating deals, your partner should have other critical skills such as:

- Analysing deals

- Supervising contractors

- Screening tenants

- Raising money

Your real estate investment team needs these skills for deals to be executed well. It’s important that the team also has a balanced risk appetite. Everyone on the team shouldn’t be daredevils or too risk averse. A deal should be passed on if the team can’t come up with an acceptable solution to a potential major risk.

I suggest you limit the size of the partnership to no more than three or four people. The decision-making process becomes more difficult when the group’s size increases.

Additionally, everyone on the team needs to appreciate that not everyone will be involved in the project to the same degree as others throughout the entire process. But, everyone should be willing to help along the way.

Partnering with someone is risky. Take the time to learn about each other before embarking on a project together.

Talk through some scenarios, especially difficult ones, to get some insight into each other’s minds. Don’t ignore the influence of the significant partners in their lives and your partners’ stages in life.

They may be willing participants, but the timing may not be ideal. Be mindful of their motivations. Ensure that the terms of the partnership are put in writing including clear conditions for dissolving the partnership if it doesn’t work.

10. Not Doing Your Own Research

The right mentors and expert advisors can help you advance rapidly as a real estate investor in Jamaica. They can put you in contact with reliable contractors, good real estate agents, and perhaps act as references when you’re applying for a loan for your investment property.

But, this valuable network can’t replace the work you have to do yourself to understand how to invest in real estate in Jamaica. Your research will help you find strategies that will work best for you.

Understanding what works for you is critical. A good deal for another person may not be a good deal for you. Your ability to pass on a deal is just as important as knowing when it’s the right time to say yes.

Final Words

Investing in real estate in Jamaica has its perks. You can have a better chance of success as a newbie if you avoid the ten common mistakes mentioned in this article.

Remember:

- Pass on deals that look too good to be true.

- Do your research so that you know the best real estate investment options for you.

- Partner with at least three or four people who aren’t your immediate relatives.

- Save enough money for the downpayment and other relevant investment fees.

- Start with what you can manage. It’s good to dream big, but learn to dream wisely.

What questions do you have about becoming a real estate investor in Jamaica? Let us know in the comments below.